Climate change is a problem that affects us all. In fact, energy use in homes currently accounts for 14% of the UK’s total carbon emissions. Despite that, the ‘green mortgage’ market is still in its infancy.

IMLA’s Green Mortgages report was designed and delivered by Rostrum in order to explore the green finance products currently available in the market, track consumer awareness of them, and ultimately help inform the Intermediary Mortgage Lenders Association’s (IMLA’s) discussions with the Government and other players in the market in the coming months.

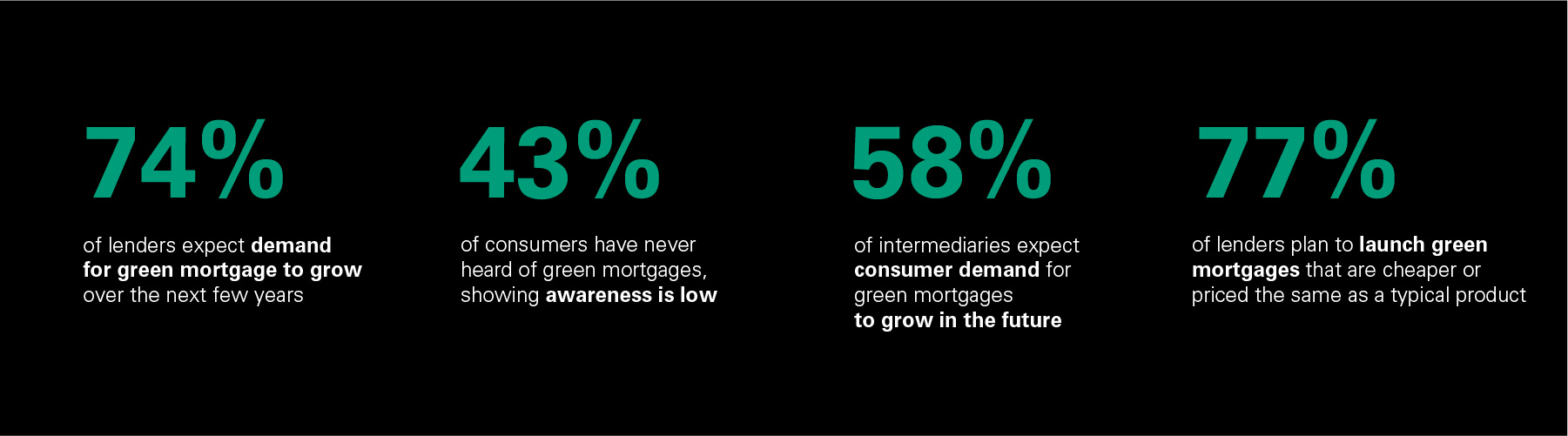

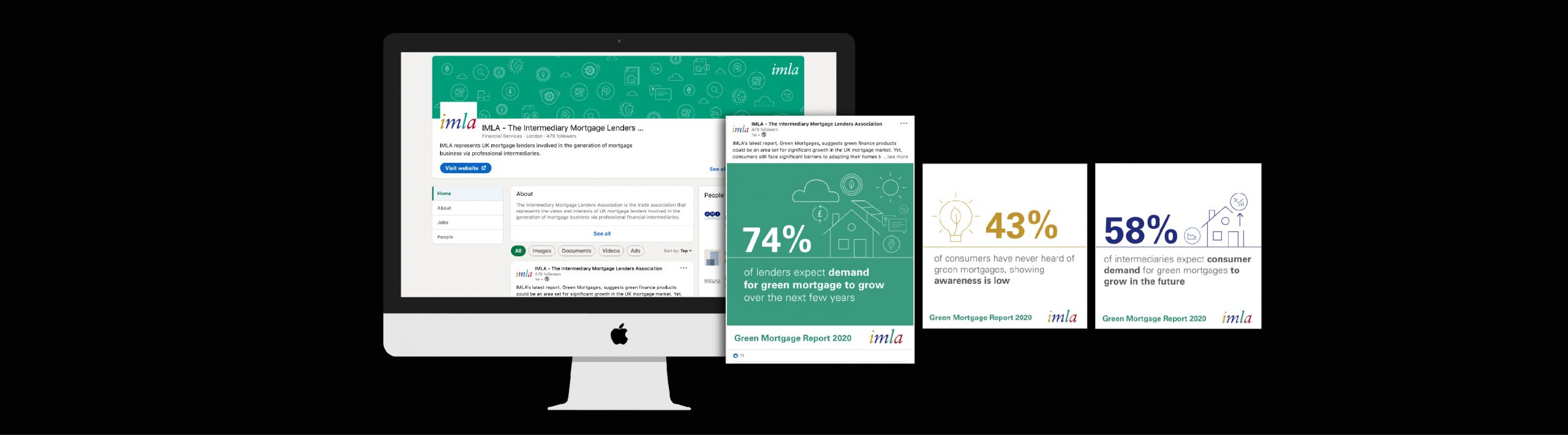

Rostrum generated the key insights for the report through surveying the core stakeholder groups – lenders, intermediaries and consumers, wrote and designed the Green Mortgages whitepaper, and created various campaign assets to bring the findings to life.

We also developed a press and social media strategy designed to generate debate, increase awareness of the green mortgage market and, importantly, engage key stakeholders with our findings.

To coincide with the EU’s Green Week initiative, we organised a ‘green takeover’ of IMLA’s LinkedIn page, which included a redesign of the existing brand logo and imagery.

The campaign was a success, with core trade publications reporting on the findings in detail, including Mortgage Strategy, Mortgage Solutions, FT Adviser, Mortgage Finance Gazette and Mortgage Introducer, among others. The report was even endorsed by SimplyBiz Group, commending IMLA’s efforts in raising awareness for green mortgage finance.

To see more of Rostrum’s work, check out our case study page, here: https://rostrum.agency/work/